Supply And Demand Zones Trading

This law states:

When supply of a product is high and the demand is low, prices must fall to incite buyer’s interest; when the demand for a product is high and supply is low, prices must rise to represent the scarcity of that product.

The supply and demand laws ultimately control all marketplaces. When discussing trading in the market, most traders depend on technical indicators to identify imbalances in supply and demand.

Demand and Supply Trading ⇒

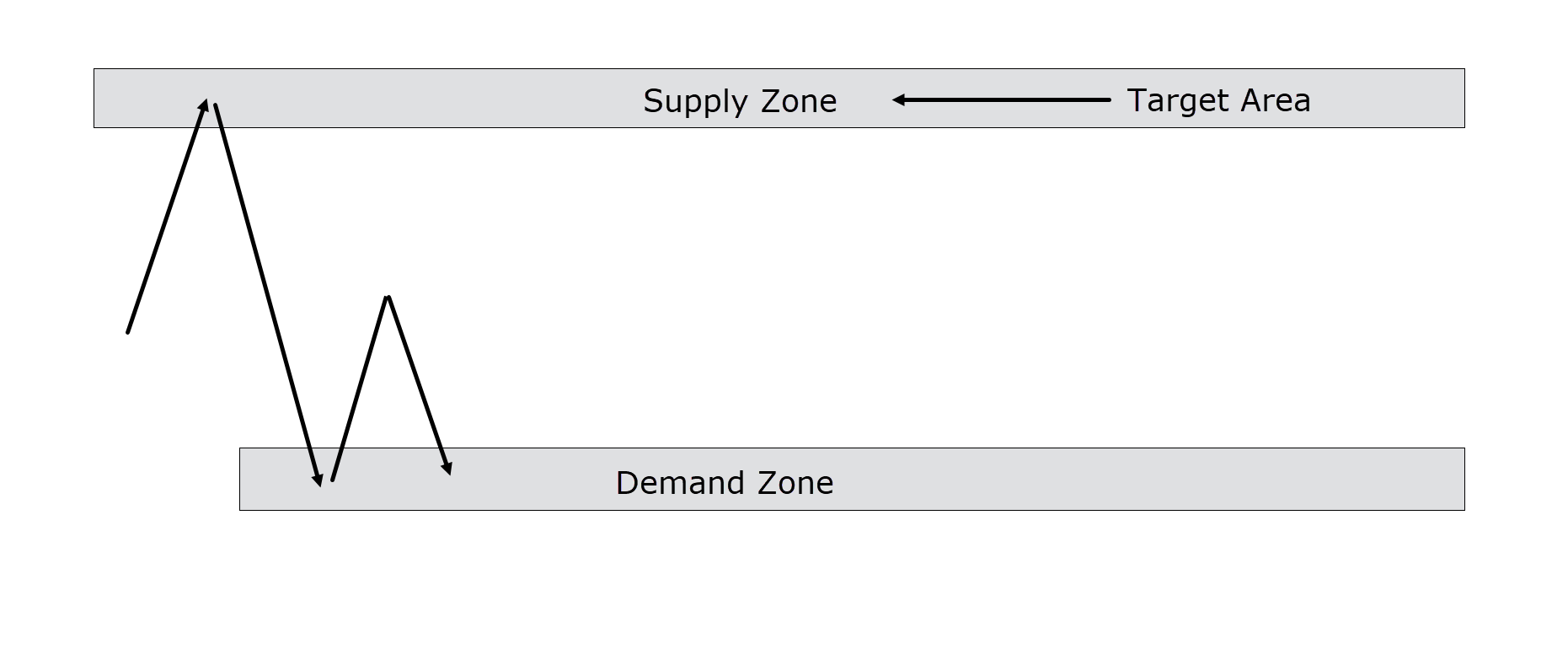

“Demand Zone”:

DEMAND ZONE ADVANTAGES

- There is minimum risk.

- There is high profit potential.

- The probability for right trade is high.

- Very easy to identify the area.

- The risk to reward ratio is more.

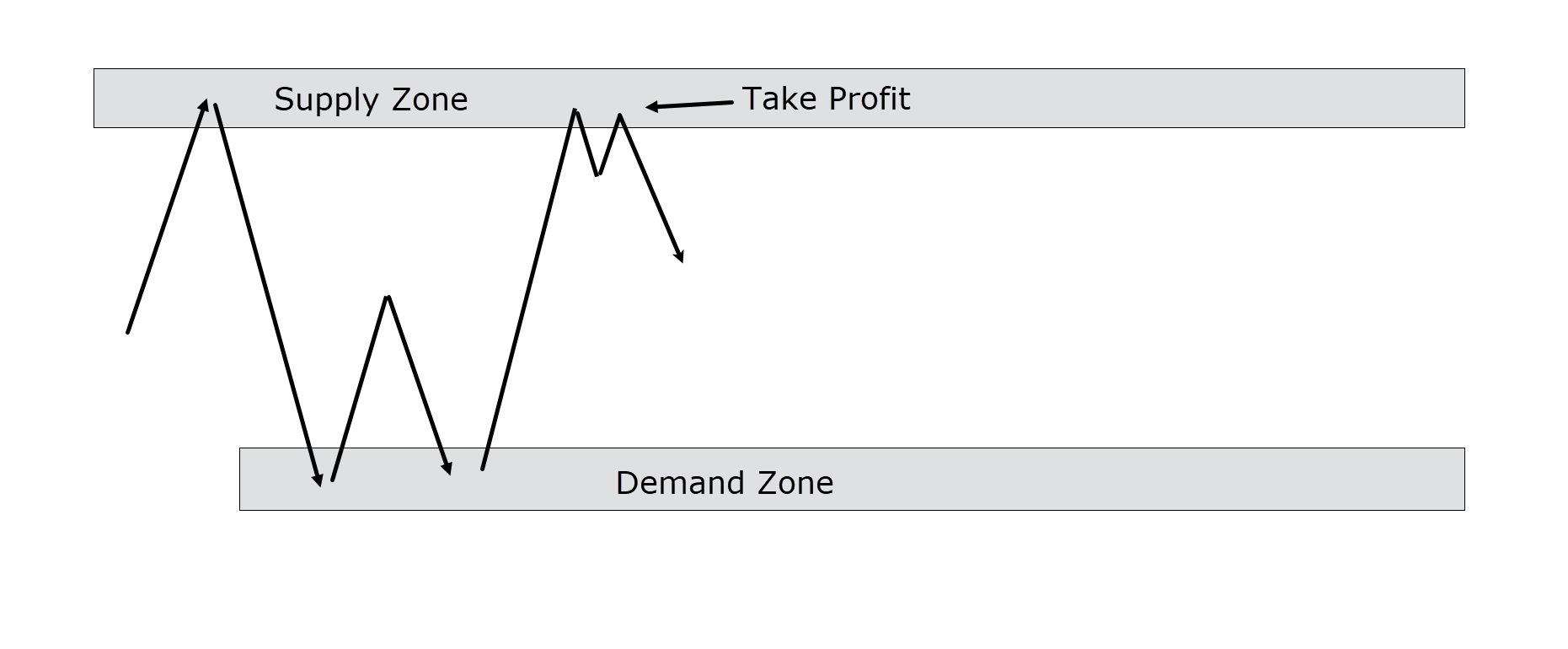

” Supply Zone ” :

Supply Zone Exit Example:

Can you see how this concept keeps you in sync with the market rather than leaving you guessing or out of touch with its dynamics?

Once you begin to grasp what’s happening behind the scenes in the market, it becomes much easier to construct a narrative about what might unfold when prices reach these critical zones.

Main advantages of selling in supply zone:

- Minimum risk.

- High profit potential.

- High probability for Right trade.

- Very easy to find out the area.

- Risk reward ratio is more.

How Demand and Supply Trading Work

- When price rises, demand outstrips supply.

- When price falls, supply outweighs demand.

- When price moves sideways, S & D are in balance.

You can see how changes in supply and demand create price moves.

First: Supply meets demand, and boom – a consolidation forms! Prices move sideways for a while, then climb higher as demand increases.

Second: Suddenly, things take a turn, and supply starts overwhelming demand! A bunch of traders—or maybe just one big whale—decides to offload a massive chunk of EUR/USD, causing price to plummet!

Supply outstrips demand for a while, as more and more people decide to sell.

They see price fall, so decide to sell themselves.

Third: Demand comes in again, catapulting prices skyward , sparking a fresh upswing. This continues until more supply enters the market. With supply and demand now in relative balance, price moves sideways, and a tight consolidation forms.

It is a “play-by-play” commentary that goes on day by day, week, month, quarter, year, etc.

Understanding this concept of Supply and Demand is an invaluable tool, as it enables you to anticipate how prices are likely to react.

Once you begin to grasp what’s happening behind the scenes in the market, it becomes much easier to construct a narrative about what might unfold when prices reach these critical zones.

Taking time to comprehend the principles of Supply and Demand can begin to shed light on why and how the market behaves as it does…

Armed with this knowledge, you can step away from feeling like you’re trading blindly.

Instead, you can create a well-laid-out plan and a solid theory supporting your trade decisions!

This can boost your confidence in trading and provide a clear understanding of where prices might bounce when these zones are breached.

Consider this scenario: Imagine marking a key Demand zone a week ago because the price made an aggressive move away from it…

0 Comments